Financial Modeling for Transmission Projects in PJM: Engineering Meets Economics

June 9, 2025 | Blog

Introduction

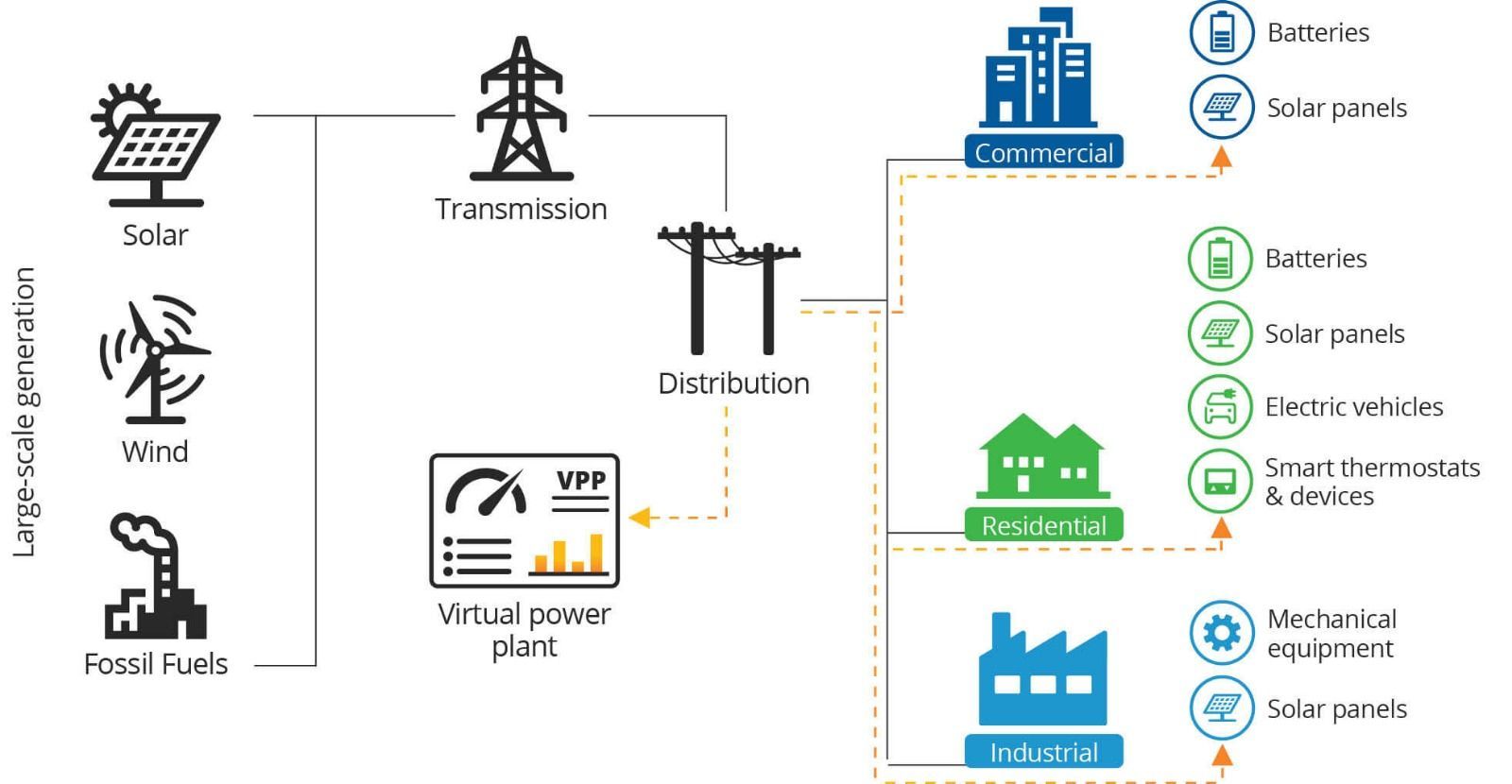

In today’s evolving power sector, aligning engineering excellence with financial precision is critical. Nowhere is this more visible than in PJM Interconnection, North America’s largest Regional Transmission Organization (RTO). Serving over 65 million people, PJM’s planning process blends technical rigor with economic modeling to deliver cost-effective and reliable grid infrastructure.

In this article, we explore how financial modeling supports the transmission planning lifecycle—and how Keentel Engineering integrates engineering and economics to help developers succeed in competitive bid processes.

1. PJM Transmission Planning Overview

1.1 The Need for Robust Planning

PJM’s Regional Transmission Expansion Plan (RTEP) ensures the grid meets reliability, policy, and economic needs. Core activities include:

- Load forecasting

- Power flow and contingency studies

- Transmission cost allocation

- Interconnection analysis

- Economic modeling

This is directly aligned with our core power system study services, including reliability assessments and grid impact analysis.

1.2 Financial Modeling in RTEP

From conceptual design to project selection, financial modeling drives key decisions:

- Net Present Value (NPV)

- Annual Revenue Requirement (ARR)

- Return on Equity (ROE)

These metrics evaluate cost recovery, ratepayer impact, and cross-project trade-offs.

2. Understanding PJM’s Competitive Window Process

2.1 Bidding for Non-Incumbents

Under FERC Order 1000, PJM accepts bids from developers (incumbents and non-incumbents) for certain transmission needs. Proposals must include:

- Technical route and voltage specs

- Permitting strategy

- In-service schedule

- Financial model documentation

- Risk mitigation and cost containment

Our team supports POI interconnection services aligned with PJM’s submission standards.

2.2 PJM Scoring Framework

Proposals are scored based on:

- Cost accuracy

- Financial viability

- Construction and permitting risk

- Innovation and efficiency

- Cost containment structures (fixed-price/capped bids)

Keentel helps clients build transparent, defensible financial models that maximize scorecard performance.

3. Core Financial Modeling Elements

3.1 Capital Expenditure (CapEx)

CapEx breakdown typically includes:

- Substation design

- Line construction (overhead or underground)

- ROW acquisition

- Environmental and permitting costs

- Inflation and contingency allowances

We use substation design and BOQ-based cost modeling to strengthen CapEx accuracy.

3.2 Annual Revenue Requirement (ARR)

ARR modeling covers:

- ROE, interest, and debt service

- Depreciation/amortization

- O&M and tax obligations

- Utility ratebase integration

ARR is essential for rate recovery and cross-RTO cost sharing.

3.3 Levelized Cost Analysis

Levelized models simplify long-term cost comparison:

- NPV-based life-cycle cost smoothing

- Ratepayer impact assessment

- Comparative scoring for proposals

4. Keentel’s Integrated Modeling Approach

Our interdisciplinary team of PE engineers, energy economists, and data analysts supports:

4.1 Technical Scoping

- Preliminary one-lines and layouts

- Load flow and stability modeling

- Contingency and thermal studies (PSS®E, PSCAD)

4.2 Cost Estimation

- Vendor quote benchmarking

- Labor and equipment inflation modeling

- CapEx comparison across RTOs

4.3 Financial Forecasting

- ARR and IRR modeling

- Monte Carlo risk analysis

- Cash flow projections

4.4 Proposal Support

- PJM-compliant Transmission Cost Tables (TCT)

- Proposal window submission templates

- Executive summaries and pitch decks

5. Common Challenges in PJM Financial Modeling

5.1 Regulatory Variability

Each PJM state has unique siting laws and regulatory review cycles. These influence:

- In-service dates

- Cost assumptions

- Environmental compliance

5.2 Risk Allocation & Scoring

Fixed-cost or capped-price proposals score higher, but they shift risk to developers. Keentel assists in designing risk-optimized bids using flexible commercial structures.

5.3 Inflation and Supply Chain Disruption

From transformer shortages to steel volatility, material price risk is real. Our team models this via sensitivity analysis, stress-testing project economics under multiple market scenarios.

6. Why Choose Keentel?

- 30+ years in Transmission & Distribution engineering

- Financial + technical co-optimization

- Experience in PJM, MISO, ERCOT, CAISO

- Rate modeling aligned with FERC and RTO standards

- Proposal support from strategy to submittal

7. Related Engineering Services

| Service | Description |

|---|---|

| Transmission Planning | Load flow, dynamic, and contingency studies |

| Protection & Control | Relay design, logic diagrams |

| SCADA & Automation | IEC 61850 engineering, RTU configuration |

| Regulatory Support | FERC 1000, state siting strategy |

| Financial Modeling | ARR, IRR, NPV, LCOT |

| Proposal Support | PJM/CAISO submission packages |

Explore our owners engineer services for end-to-end transmission project support.

8. Conclusion

Transmission financial modeling is no longer just a cost exercise — it's a strategic differentiator. Developers that combine strong technical designs with credible, transparent economics are better positioned to win in PJM’s competitive framework.

At Keentel Engineering, we support clients through every stage — from conceptual design to bankable submission. Whether you’re preparing for a PJM proposal window or validating project economics, we can help engineer your success.

Ready to Strengthen Your Next PJM Submission?

Keentel offers integrated transmission modeling, cost forecasting, and proposal support tailored to PJM’s evolving requirements.

📩

Contact us today to get started with a reliable, bankable submission strategy.

About the Author:

Sonny Patel P.E. EC

IEEE Senior Member

In 1995, Sandip (Sonny) R. Patel earned his Electrical Engineering degree from the University of Illinois, specializing in Electrical Engineering . But degrees don’t build legacies—action does. For three decades, he’s been shaping the future of engineering, not just as a licensed Professional Engineer across multiple states (Florida, California, New York, West Virginia, and Minnesota), but as a doer. A builder. A leader. Not just an engineer. A Licensed Electrical Contractor in Florida with an Unlimited EC license. Not just an executive. The founder and CEO of KEENTEL LLC—where expertise meets execution. Three decades. Multiple states. Endless impact.

Services

Let's Discuss Your Project

Let's book a call to discuss your electrical engineering project that we can help you with.

About the Author:

Sonny Patel P.E. EC

IEEE Senior Member

In 1995, Sandip (Sonny) R. Patel earned his Electrical Engineering degree from the University of Illinois, specializing in Electrical Engineering . But degrees don’t build legacies—action does. For three decades, he’s been shaping the future of engineering, not just as a licensed Professional Engineer across multiple states (Florida, California, New York, West Virginia, and Minnesota), but as a doer. A builder. A leader. Not just an engineer. A Licensed Electrical Contractor in Florida with an Unlimited EC license. Not just an executive. The founder and CEO of KEENTEL LLC—where expertise meets execution. Three decades. Multiple states. Endless impact.

Leave a Comment

We will get back to you as soon as possible.

Please try again later.